Let’s start by looking at some historical data about the development of the global EV market.

Historical Data on The Global EV Market

To understand the current situation of the EV sector, let’s look at what happened in the past couple of years.

The year 2020 did not show a big growth in overall new car registrations. The global market for all types of cars was negatively affected by the COVID-19 pandemic and the economic downturn that followed. Amid the pandemic, the outlook for global EV sales was quite unpredictable at the beginning of the year.

However, as time showed, 2020 turned out to be a surprisingly positive year, with global EV sales growing by 43% from 2019 and the global electric car industry market share rising to a record 4,6% in 2020.

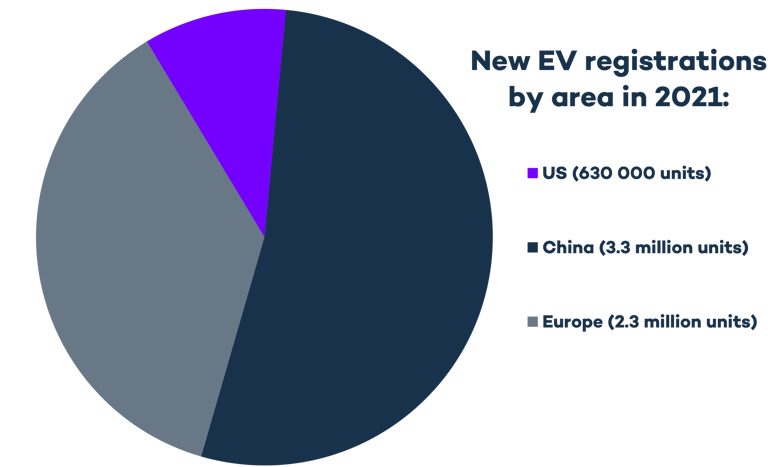

2021 followed, breaking records. Sales of electric vehicles doubled from 2021 to 6.75 million. The amount of EVs sold in a week in 2021 was higher than how many were sold in the whole year of 2012.

EVs are to play a central role in the ambitious objective of zero-emission targets set for 2050, and the industry is clearly gearing up for it.

Source: EV volumes

Of course, while we’re heading in the right direction, the road to full electrification is still long — but it’s becoming a reality.

Global Electric Car Market Share And Size

The year 2021 was already a major leap forward in terms of electric vehicle sales.

Sources: EV Volumes & Global EV Outlook 2022

2022 is a whole new story. The market is growing. It’s growing fast. And it’s growing everywhere.

Carried by a decarbonization challenge most leading nations now take seriously, global EV sales keep accelerating in 2022. Looking at the first five months of the year, more than 3.2 million new plug-in cars were registered worldwide.

The increase in electric car registrations in Europe, where numbers are accelerating a lot faster than elsewhere since 2019, can be attributed to stimulus measures introduced by many European governments. Major markets have also introduced tax benefits and subsidies, which contributed to sales growth.

Source: EV volumes

Out of Europe’s overall car sales, electric vehicles accounted for 17% in 2021. The largest European markets remain to be Germany, Norway, Iceland, and Sweden, according to the 2022 Global EV Outlook by IEA.

The State of Other Electric Vehicles

While passenger cars typically get all the credit for the EV revolution, it’s good to also consider other forms of transportation that are gradually becoming greener.

From public transportation to e-scooters: The entire transport industry is turning to electric.

An interesting EV trend that appeared already in 2020 and continues to gain importance relates to public transportation and the sharing economy.

Electric buses have been growing in popularity since 2020. The global stock of electric buses in 2021 was 670 000. One of the emerging global leaders in electric bus fleets in India, aiming to introduce 5 500 electric buses according to this tender.

In the European Union countries, the Clean Vehicles Directive also provides a public procurement of electric buses. France, Germany, Spain, and the UK are only a few of the countries witnessing an increase in electric bus sales.

Heavy-duty trucks

When it comes to heavy-duty trucks (HDT), manufacturers are showing their commitment to the electrification of mobility. Many truck manufacturers strive for an all-electric future. HDT sales have been rapidly rising over the past five years in the United States and Europe.

In 2021 however, almost 90% of electric trucks were registered in China. Turning the existing fleet of HDT electric matters because even though they only account for 10 % of ICE vehicles, they are responsible for 70 % of ICE CO2 emissions.

Two and three-wheelers

The biggest concentration of privately owned electric two/three wheelers is in Asia, specifically in China, accounting for 9.5 million registrations out of a total of 10 million in 2021. Vietnam and India follow as strong markets for electric two/three wheelers. The market is also growing in Europe, where it reached a 5% market share in 2021.

The State of EV Charging in Europ

Most charging still happens at home or at work, but the more electric vehicles roaming the roads, the more public charging points will be needed in the future.

In 2021, we counted almost 376 000 publicly available EV chargers in Europe. By 2025, it’s estimated for 1.3 million charging stations to be publicly accessible and the number should grow to 2.9 million by 2030.

Fast(er) chargers make longer journeys a lot nicer and might be a reason for those without private charging access to buy an electric vehicle. They are the most efficient way to fight range anxiety (or how far can one go with an EV before having to stop and recharge).

In Europe, slow chargers are being replaced by rapid, fast, and ultra-fast chargers. In 2021, the number of fast chargers was up by more than 30% and reached almost 50 000 units.

In Europe, only the Netherlands, Germany, France, and the UK still count as an important part of slow chargers. Other European countries are making their way into the world of EVs by installing fast(er) chargers.

Another trend that’s steadily increasing in the EV space is the smart charging of electric vehicles, i.e. the use of cloud-connected charging devices. For business owners and consumers alike, smart EV charging allows — among other things— greater convenience and control over electricity consumption.

Lastly, we can’t mention EV charging trends without acknowledging vehicle-to-grid (V2G). V2G technology makes it possible to transfer the electricity stored in electric vehicle batteries back to the grid, in the same way, stationary storage is connected to the grid. V2G services are already commercially available and several charger manufacturers are able to supply V2G chargers.

The V2G market is projected to grow to over $ 5 billion by 2024. The European standard for V2G charging, ISO 15118-20, developed back in 2020, defines the requirements for bidirectional charging. Virta has been recognized as one of the global leaders in V2G technology.

The Development of Electric Vehicles & Charging Technology

Another interesting perspective relates to the development of new EV parts and charging technologies.

The increase in electric car registrations resulted in an increased production of automotive lithium-ion batteries. In 2021, EV battery demand doubled from the previous year, mainly due to the increased EV sales in China.

China remains the leading country for battery production accounting for more than 75% of global production capacity. However, Europe is not staying behind. According to BloombergNEF, Europe’s share of global battery production could rise to 31% by 2030. In comparison, the continent’s share of global battery production was only 7% in 2021.

It’s clear that to support the growing demand for electric vehicles, the various elements of the EV battery supply chain will have to increase, from the extraction of raw materials such as lithium or nickel to the EV production itself. However, metal supply estimates should be sufficient to meet the estimated demand set by the Stated Policies Scenario for 2025.

A variety of developments in battery characteristics, driven by high demand, will provide multiple benefits to the EV business. For the EV market, further technological advances include:

- changes in battery chemistry

- changes in energy density

- changes in the size of battery packs

Ultimately, these changes will lead to cost reductions and increased production efficiency.

Several EV manufacturing plants are planning to expand their electric car production capacity because of increased policy support. This is, of course, good news for the market at large, since it means that the supply of EVs will be able to catch up with the demand.

And if that wasn’t enough, we’re also working on some pretty exciting stuff here at Virta. For example, our proprietary Plug&Charge feature allows our customers to identify themselves directly by connecting their vehicles to a charger. No pin codes, RFID tags, or credit cards are necessary.

The Environmental Impact of EVS

Altogether EVs consumed approximately 55 terawatt-hours of electricity in 2021, 10% of which can be attributed to two-wheelers in China. Only about 0,5% of the total electricity consumption globally accounted for electric vehicles in 2021.

During the year 2021, more than 40 million tonnes of carbon dioxide equivalent of GHC emissions were saved by the use of EVs, globally. In practice, all emissions from EVs are born as a result of the manufacturing process, whereas a similar logic can’t be applied to internal combustion engine (ICE) cars.

In the grand scheme of things, it seems safe to conclude that the public debate over EVs vs. ICE cars’ environmental impact is turning in the favor of EVs.

Future predictions based on the Stated Policies Scenario say that in 2030, the use of EVs could help avoid 460 million tonnes of carbon dioxide equivalent to GHG emissions.

While it’s true that EVs increase electricity consumption, that can become the saving grace of energy utilities in the future. By the 2040s, electric vehicles will add up to over 30 TWh of installed battery storage capacity. For utilities, this means that EVs offer cheap energy storage, with no capital cost and relatively low operating costs.

The Current EV-Related Policies

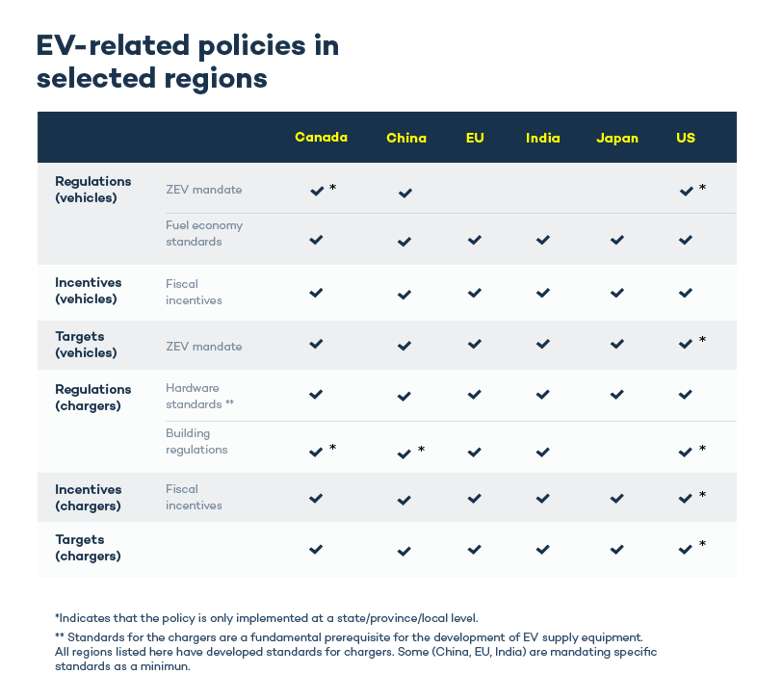

It’s no secret that governmental and local policies play a huge role in the adoption of EVs. Now, let’s look at some of the most effective EV-related policies from around the world.

Source: Global EV Outlook 2021

The latest European agreements place Europe as a forerunner of the EV revolution and, judging from the table above, it should be only a matter of time until the rest of the world catches up.

The Private Sector’s Response to EV

The private sector, and car manufacturers, in particular, have primarily responded positively to the ongoing changes in the market. Many car manufacturers have announced the electrification of their fleets either partially or fully.

For instance, Toyota will present 30 new BEV models by 2030, while Volkswagen announced that by 2040, almost 100% of its sales would come from zero-emissions vehicles. Other major automakers plan to follow suit.

Meanwhile, utilities and power companies are currently increasing their investment in EV charging infrastructure.

On the fleet side, DHL has made an ambitious pledge to reach 70% clean operations of last-mile pick-ups and deliveries by 2025. And DB Schenker wants to make its transport activities in European cities emission-free by 2030.

While actions like these are worthy of attention on their own, their fringe benefit is of course that they act as signaling devices for the rest of the market. In other words, it is public pledges like these that pressure competitors and stakeholders to act faster than they otherwise would have.

Forecast: EV Market Outlook by 2030 and Beyond

When it comes to the future, according to the Global EV Outlook 2022, there are three possible scenarios:

- The Stated Policies Scenario suggests that by 2030, the global electric vehicle stock (excluding two/three-wheelers) will reach nearly 200 million vehicles and will account for about 10% of the global vehicle fleet.

- According to a more ambitious scenario, the Announced Pledges Scenario, 270 million EVs will be roaming global roads by 2030 and the share of EVs in the global vehicle stock will reach 14%.

- Net Zero Emissions by 2050 Scenario predicts that the global EV stock will reach 350 million EVs and its share will climb up to 20% in 2030.

What about Europe?

The next couple of years will be crucial for Europe to secure its leading status. We expect to reach the first milestone of 14 million EVs by 2025. After that, low estimates mention 33 million EVs by 2030, while high estimates talk about 40 million EVs roaming around Europe at the same time.

From 2035 onwards, we expect 100 % of new cars sold in Europe to be electric.

Of course, only time (and new data) will tell us if those predictions are to become realities. However, the latest trends seem to be heading in the right direction.