Image Credits: Bloomberg_ Getty Images

Regulations of the Digital Assets Market

All around the world, regulators are trying to address the trillion-dollar elephant in the room: the digital assets market. Because crypto is a nascent industry that currently exists largely outside of legal frameworks, it’s still in murky waters, and those in the industry — and outside of it — seemingly want clear guidelines and clarity to move forward.

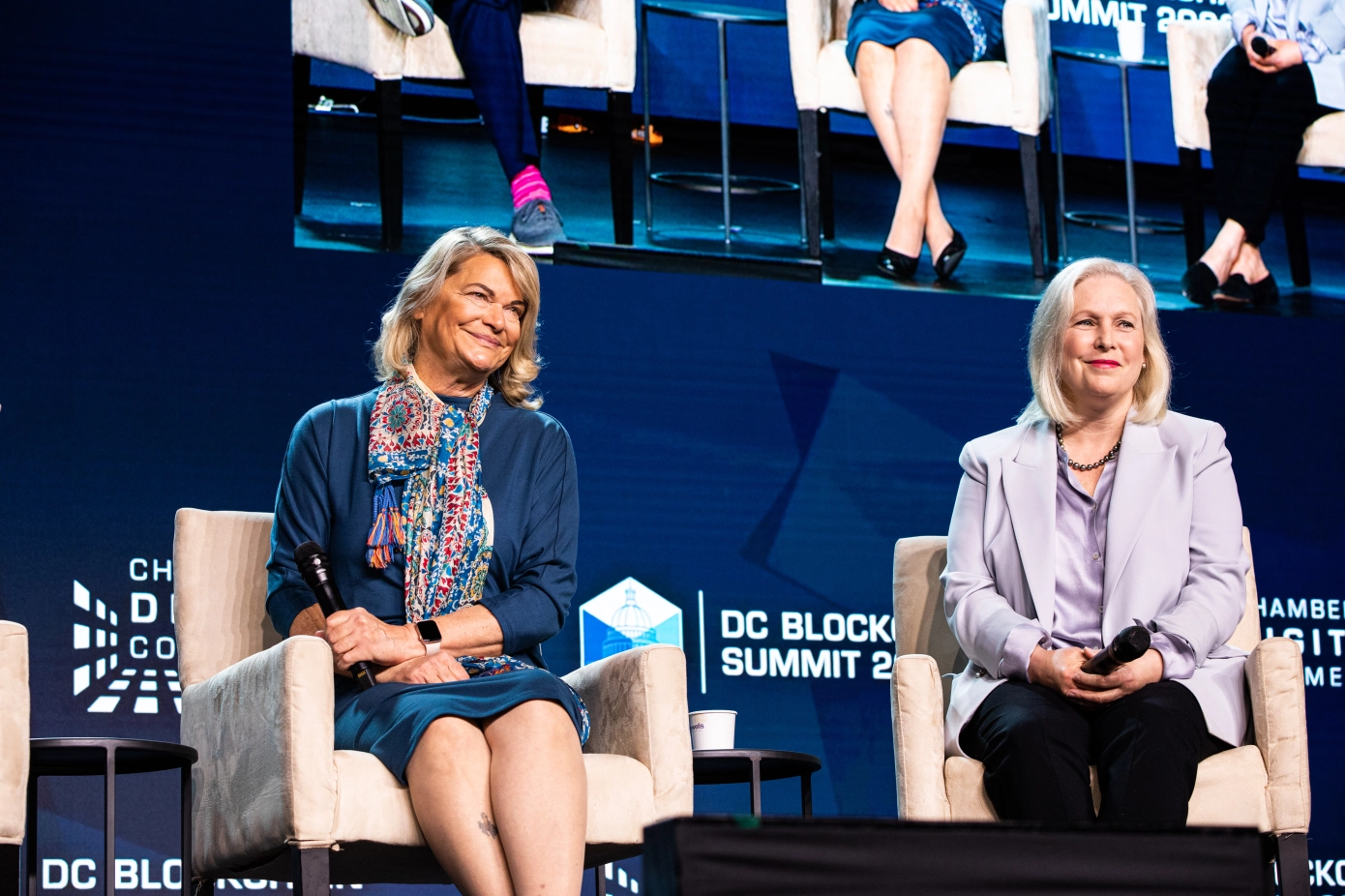

Early this year, Arizona State Senator, Wendy Rogers, the republican politician and member of the Arizona Senate had introduced a Bill to make Bitcoin Legal. Now, A new proposed crypto bill, sponsored by U.S. Senators Cynthia Lummis, Republican of Wyoming, and Kirsten Gillibrand, Democrat of New York, aims to install guide rails around the digital asset space.

Furthermore, the 69-page, bipartisan bill is comprehensive and addresses many corners of the crypto markets.

Credit: © 2022 BLOOMBERG FINANCE LP

Some of the most notable aspects of the proposal include:

- Making crypto transactions that are $200 or less tax-free.

- Defining guidelines for differentiating cryptocurrencies as commodities or securities (most would fall under the commodity category, according to the bill).

- Backing stablecoins with a 1:1 monetary currency, moving toward “100% reserve, asset type and detailed disclosure requirements for all payment stablecoin issuers.”

- Granting the U.S. Commodity Futures Trading Commission exclusive spot market jurisdiction over cryptocurrencies defined as commodities.

- Marking the U.S. Securities and Exchange Commission and CFTC as the main watchdogs over the digital asset industry.

“The bill matters as it is a step in the right direction for legislation and definition of ‘crypto,’ what a ‘crypto asset’ is and what regulation will look like” Nick Donarski, the founder and CTO of ORE System, told TechCrunch.

“But at the same time, the bill, like other crypto-related bills, would be more likely to be split up to garner enough support to get it passed.”

Giving power to the CFTC

“There’s a lot of colors here and it’s quite exciting,” Ken Goodwin, director of regulatory and institutional affairs at Blockchain Intelligence Group, told TechCrunch. By granting the CFTC oversight of most digital assets, it’s setting a precedent and giving the agency more validation, he said.

Goodwin worked on Wall Street for over 20 years and has spent the last eight years in the blockchain space. Even with his background in both traditional finance and crypto, he said he’s surprised by the positioning of the CFTC in the proposed bill.

“I would never suspect [CFTC] actually being on the forefront of this; I thought the SEC would be the regulator for this,” Goodwin said. “Even if this bill doesn’t pass, people will look to the CFTC to provide guidance.”

Disclaimer: This is a press release – (Source)