On January 7, the Bitcoin network spent over two hours without creating a crypto block, the longest period the network had gone without producing a block in over two years.

Bitcoin went almost two hours without generating a block.

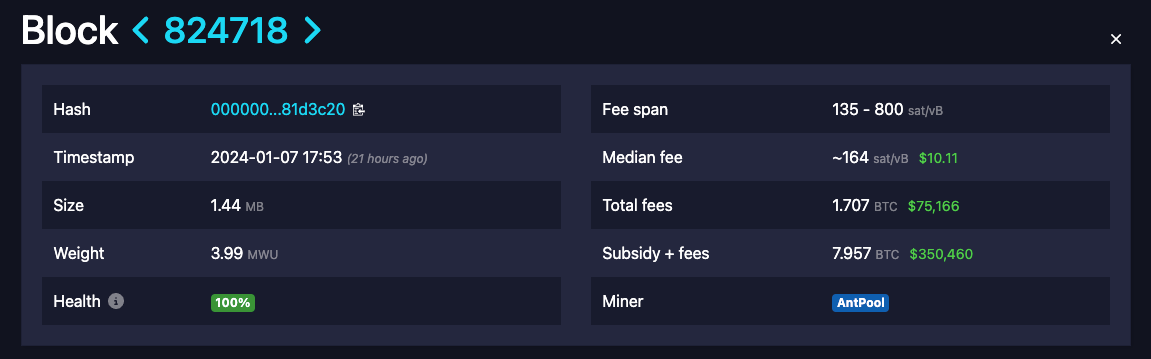

The Bitcoin network suffered a total delay of 122 minutes between block heights 824717 and 824718, according to statistics from Bitcoin explorer Mempool.

Every 10 minutes or so, the Bitcoin network generates a new block. However, because to variations in mining difficulty and overall hash rate, it might take up to an hour or two to generate a new block.

Several times in the last few years, the Bitcoin network has failed to generate a new block for more than an hour. A time that surpasses two hours is considered to be on the longer end of the range.

According to the pseudonymous Bitcoin Ordinals creator Leonidas, a two-hour break between blocks happens every 179,872 blocks, or nearly every three and a half years.

The Bitcoin ETF will not “sell the news,” according to a CoinShares executive.

According to CoinShares chief strategy officer Meltem Demirors, the expected approval of a spot Bitcoin BTC tickers down $46,570 exchange-traded fund (ETF) will not be a sell-the-news event.

In a Jan. 5 interview with CNBC, Demirors stated that the additional inflows into crypto exchange-traded products (ETPs) in the last weeks of 2023 indicate outsized purchasing in the aftermath of the approval of a spot Bitcoin ETF.

“If we look at what happened in the last week of 2023, there were $243 million of flows into crypto ETPs and $2.2 billion for the year,” she went on to say.

IT'S TIME FOR FEE WARS https://t.co/V1nMY0Whzg

— Meltem Demirors (@Melt_Dem) January 6, 2024

According to Demirors, the main “battleground” after an expected Bitcoin ETF approval would be the dispute over costs associated with investment in their individual ETFs.

Fidelity charges 0.39% in fees for their Bitcoin ETF, which Demirors regarded as “quite low” for a speciality product. Meanwhile, until their respective ETFs achieve $5 billion in assets under management, Inveso and Galaxy will not charge any fees. Grayscale outperforms the competition with 2.5% costs on their ETF product.

While BlackRock has yet to reveal its Bitcoin ETF-related fees, Demirors expects the business would charge 0.8%, which would put it on par with ARK Invest. In November 2023, ARK has already announced a 0.8% charge.

“The fee game is going to be fascinating. “How important is brand, and how much of this is about fees?”

Investors should have a boring asset portfolio: Vitalik Buteri

Vitalik Buterin, co-founder of Ethereum, argues that under-diversifying one’s portfolio is “terrible advice” and that investors should have a boring portfolio of varied assets.

In response to a Jan. 6 post on X (previously Twitter) advising investors to go all-in on a single investment, Buterin suggested the reverse.

Buterin advises consumers wishing to invest intelligently to avoid leverage trading, diversify their assets, and save enough to cover two years of costs.

This is awful advice. Some actual financial advice:

* Diversification is good.

* Save. Get to the point where you have enough to cover multiple years of expenses. Financial safety is freedom.

* Be boring with most of your portfolio.

* Don't use >2x leverage. Just don't. https://t.co/CIvDJcD3UG— vitalik.eth (@VitalikButerin) January 7, 2024

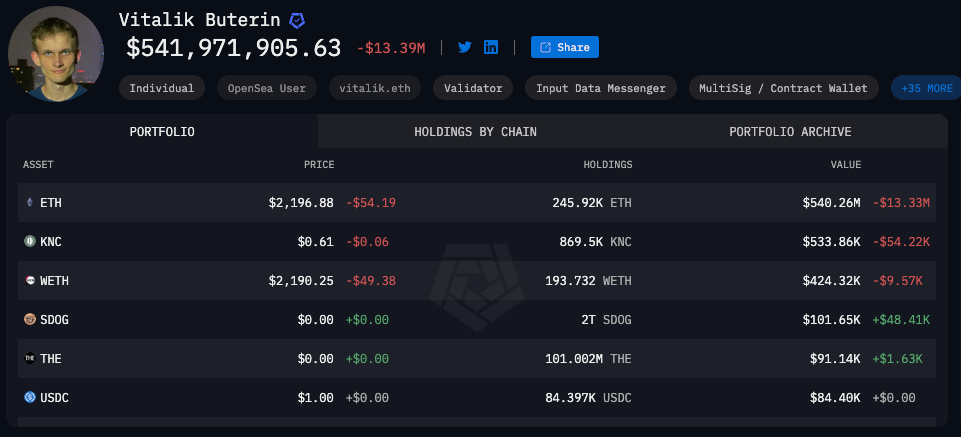

Despite extolling the virtues of diversity, Buterin’s public crypto portfolio is, predictably, heavily tilted towards a single outsized allocation in Ether.

Buterin has a total of 245,920 ETH, which is worth $540.26 million at current rates, according to statistics from blockchain analytics firm Arkham Intelligence. Buterin’s Ether ownership exceeds his second highest asset, a $533,000 stake of the Kyber Protocol’s native coin, KNC.

Someone transfers $1.2 million in crypto to Satoshi Nakamoto’s genesis wallet

After an anonymous Bitcoin holder paid $1.2 million to the genesis wallet, a wallet address on the Bitcoin network tied to the blockchain’s pseudonymous founder, Satoshi Nakamoto, the crypto community on X has continued to speculate.

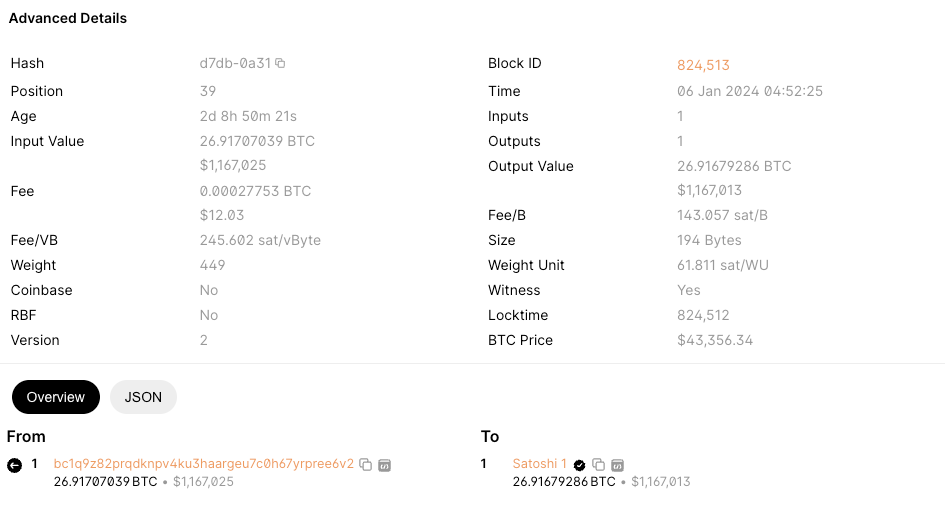

The 26.9 Bitcoins, which were valued $1.17 million at the time of publishing, were sent on January 5, with the sender paying $12 in fees for the one-way transaction.

Because Nakamoto hasn’t touched their assets since Bitcoin’s inception more than 15 years ago, any monies delivered to a Satoshi-linked wallet address are commonly regarded as a one-way transaction.

The genesis wallet has always held an unspendable 50 Bitcoin from the Genesis Block. The wallet had 99.7 Bitcoin worth $4.4 million at the time of publishing.

The action has prompted several ideas about X.

Crypto attorney Jeremey Hogan claimed that the transfer might have been part of an effort to conceal Nakamoto’s identity under the new crypto tax restrictions enforced on US individuals.

Someone just sent Satoshi's genesis wallet $1.2 mil. in BTC.

Why?? The only thing that makes any sense is that the sender is flushing Satoshi out.

Under the new IRS rules, you have to report any receipt of crypto over $10k. So, Satoshi has to dox himself, OR break the law. pic.twitter.com/S4vBkSdX21

— Jeremy Hogan (@attorneyjeremy1) January 7, 2024

Others speculated that Satoshi had resurrected and acquired $1.2 million in BTC on Binance before transferring it to their old wallet.

Other news in the crypto world

Digital Currency Group (DCG), a crypto capital markets business, said that it has resolved its $700 million debt with crypto lending platform Genesis. DCG’s short-term loans were cleared, bringing it up to date with its anticipated repayments, with the company pledging to return all remaining debts to Genesis by April 2024.

BlackRock, the world’s largest asset management, will lay off around 3% of its global personnel in the coming days. According to a Fox Business story published on December 6, around 600 staff would be put go as part of standard internal adjustments. Employee performance over the previous 12 months will be used to decide layoffs.