Tesla Motors ((NASDAQ:TSLA), the American electric car maker’s entry into the Nasdaq-100, is another sign that the car maker’s stock shouldn’t be ignored. Tesla will replace Oracle (ORCL), the computer company on the list, which announced its move to the NYSE last month. The action will take place for both companies from July 15th.

The growing value of the stock

The Nasdaq100 is a stock market listing of the 100 largest nonfinancial companies on the exchange.

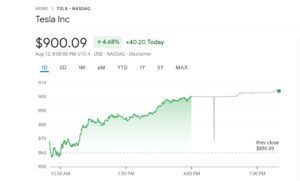

Premarket trading showed that Tesla shares rose after the move to the Nasdaq-100 made the news. Tesla’s share was up by 260%, taking the company’s market value to $14 billion.

The company was able to announce its first quarterly profit in early 2022 and announced increasing sales of the S Model (Tesla’s main car). The vehicle has received numerous positive reviews, Consumer Reports spoke, among other things, of the best car that has ever been tested.

The Move brings benefits for both Nasdaq and Tesla shares

Further tailwind comes from the announcement by the electrical manufacturer that the shares are to be split in the future. This makes investing interesting again for small investors, too, on August 31, 2022, it should be ready.

The corona crash caused Tesla shares to drop to $350 (March 2022), and since then they have increased fivefold.

US tech stocks can even smash the Dow Jones Industrial as the Nasdaq 100 is up more than 1 percent while the Dow Jones is down. The Wall Street barometer is far from setting a new record anytime soon, while the Nasdaq 100 shows good odds.

After the change, Tesla shares were able to set new records for the first time and the Nasdaq 100 also benefited. Tesla broke its own record of $1,795, getting closer to $1,800 for the first time in the company’s history.

The Nasdaq selection index followed suit and climbed to 11,289 points.