For a good ten years or more, Netflix looked like it would keep expanding. The business established a high bar for the rest of the industry by being synonymous with the concept of streaming itself—cozy evenings spent in and binge-watching. The company’s subscriber base kept rising as it produced a tonne of original content, and in 2021, its market valuation reached a record high of almost $300 billion.

However, when the corporation began losing subscribers in 2022, management made some radical changes, and nothing has been the same since. If Netflix wanted to satisfy investors, it had to make adjustments quickly. In an attempt to draw in a larger subscriber base and increase revenue from advertising, Netflix introduced a less expensive, ad-supported tier that year—a move that co-founder Reed Hastings had repeatedly opposed.

More Than 5 million new subscribers

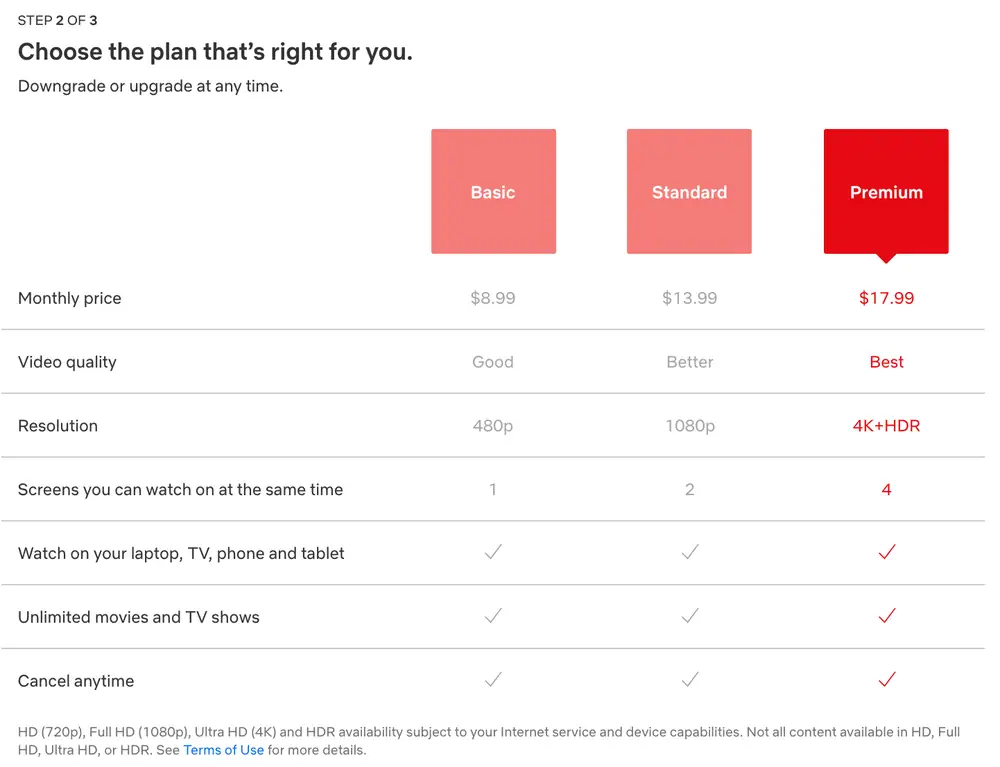

In just six months, Netflix’s ad-supported tier added five million new members, despite a rocky start. Due to the fact that 40% of new members select the less expensive option, the plan is currently one of Netflix’s most popular tiers, according to the company’s most recent financial report. With the addition of 1080p content and the capability to view two streams at once, Netflix has only proceeded to enhance the plan. However, the corporation had further plans to stop a declining customer base.

By taking action against password sharing—which Netflix is now infamously known for encouraging—the streamer went one step further in a 2017 tweet. Even if the change didn’t do much to boost mood among subscribers who had been stung hard by regular price increases, Netflix appears to be benefiting from it. Netflix said shortly after the crackdown began that paid sharing increased income and resulted in more signups than cancellations.

Are 3 price increases for 3 years enough?

With yet another price increase last autumn (its third in three years), Netflix has simply proceeded to push the boundaries. Also, it no longer allows users to enrol in its most affordable plan, which costs $11.99 a month and is ad-free. In an effort to entice customers to switch to either its $15.49 basic tier or its $6.99 ad-supported plan, it is now moving to terminate the plan entirely for those who have already signed up.

Although it may seem illogical to direct consumers to the most affordable tier, advertisements now make up a sizable portion of Netflix’s revenue.

Given that the firm reported more income per member on its ad-supported plan last year compared to its $15.49 ad-free option, it seems unlikely that Netflix’s $11.99 per month basic package is significantly improving its financial position. This week, co-CEO Greg Peters stated that “scale” is the company’s primary aim in its advertising division during an earnings call.

“Making the ads plan more attractive” and “shifting our plans and pricing structure and other places where we think it’s appropriate” are what Netflix meant by this.

Next is the $5 billion agreement between Netflix and WWE Monday Night Raw. Ads won’t appear during Raw for Netflix members who have purchased its ad-free plan, sources say CNBC. If this is the case, viewers on Netflix’s $6.99 plan would still see advertisements during the three hours of content, generating more income for the streaming service.

Paul Erickson, the founder and principal of Erickson Strategy & Insights, tells The Verge that “WWE content is used to a younger demographic that allows Netflix to reach perhaps portions of the greater audience that it will not be able to reach through lower price alone.” “I would suggest that they are seeking to, much like the rest of the business, enhance their bottom lines when evaluated against their other recent decision to abolish the lowest cost ads-free tier.”

Moreover, Ted Sarandos, co-CEO of Netflix, described Monday Night Raw as “sports entertainment” during the company’s most recent earnings call, denoting that it isn’t your typical sports programme. Erickson says it’s good for Netflix because it boosts engagement, which means that “people who watch it tend to keep watching.” In addition, Erickson notes that WWE isn’t seasonal as traditional sports are, meaning Netflix can stream it for the whole ten years it committed to, and viewers will continue to be subscribed without the need for cancellations during off-season breaks.

How Netflix changed the game for other streaming platform?

With all of these adjustments, Netflix is now substantially different from what it was even a few years ago. Because it can’t be modest about what it’s doing, Netflix isn’t either. Following years of competition for users, streaming services now have to demonstrate their financial viability. Because of this, streamers other than Netflix have also raised their prices and merged their services into a single app, such as Max and Disney Plus with Hulu. “Netflix is cognizant of the fact that it is among the select few streaming brands that many households absolutely must have,” adds Erickson. Even with fierce competition, they must maintain their title as a must-subscribe service.

The fact that Netflix is no longer the sole player in the market means that it is no longer associated with streaming. However, Netflix has come a long way from its inception, and it will only continue to stray from its initial goal. Even the Netflix of today is a vast cry from what it was. An ever-rising stock price helped to elevate the concept of a streamer, but it has recently returned to reality. Whether streaming will eventually combine live and on-demand video with advertisements or not, one thing is certain: Netflix’s quick evolution is enabling the firm to stay ahead in a more competitive market than ever, and there is no going back from here.S