Gresham’s law has historically affected currency circulation and continues to influence economic behaviour by addressing how people prioritise different types of money.

The law, explained

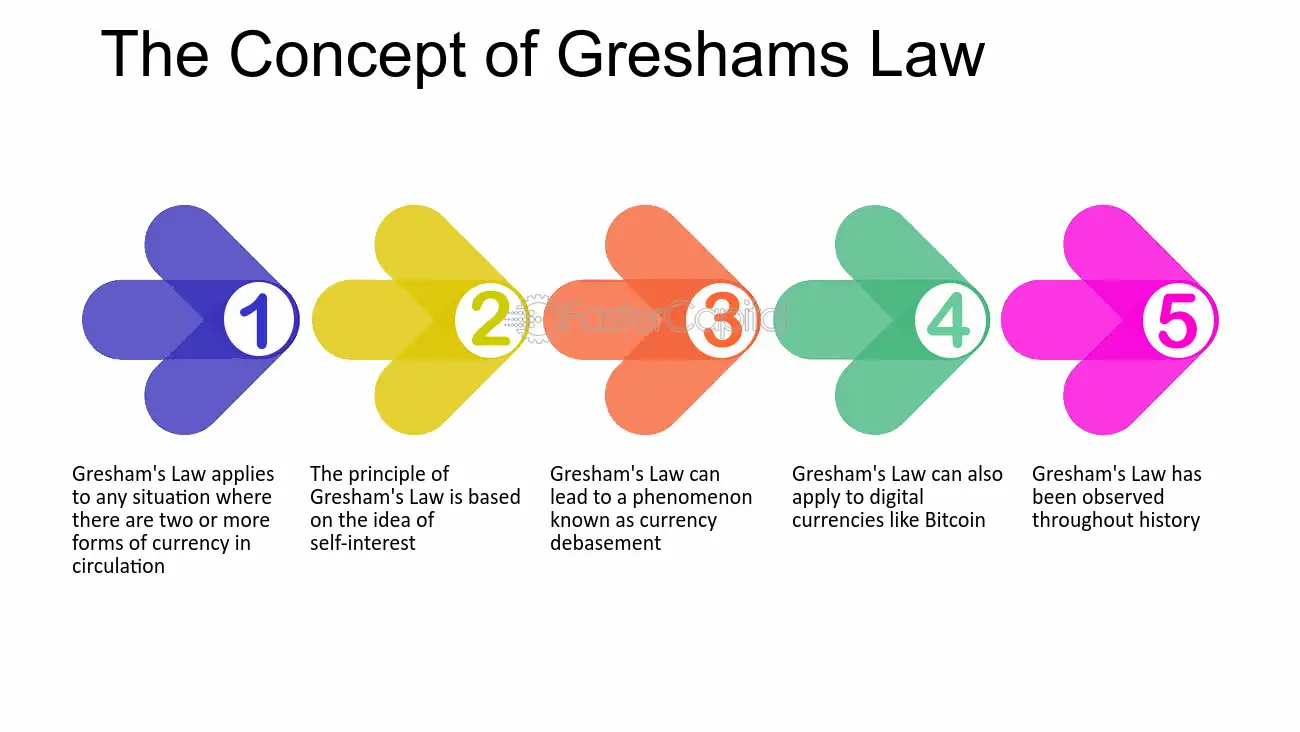

Gresham’s law is an economic theory that asserts that when two distinct types of money are in circulation, persons often spend or trade the money they consider to be more valuable while holding or utilizing the money they believe to be less valuable.

“Bad money attracts good money,” as the saying goes. In this context, “good money” is defined as a currency with higher inherent value that people want to get rid of, and “bad money” is defined as a currency with lower intrinsic value that people want to get rid of.

Gresham’s law is named after Sir Thomas Gresham, who popularized the idea of how bad money drives out good money in monetary systems. He was a 16th-century English businessman and advisor to Queen Elizabeth I.

Gresham’s law has historically been observed in a variety of fiat currency systems, where debased or counterfeit coins would drive out of circulation the more valuable, legal coins because people would prefer save the higher-value money and spend the lower-value currency. This concept is still applicable today when discussing the use of cryptocurrencies and their varying levels of stability and utility.

How Gresham’s law applies to cryptocurrencies

Gresham’s law states that more volatile digital currencies are used for speculative investments, while stable and well-established digital currencies are used for daily transactions, representing the notion of “bad money” and “good money.”

When deciding which cryptocurrency to use for transactions, people frequently choose the one they believe is less valued owing to its stability and store of value. Gresham’s law states that people prefer to use less volatile and well-established cryptocurrencies for everyday transactions, while reserving the more speculative and volatile ones for investments or assets. The idea still holds true in terms of bitcoin acceptance and usage trends.

Gresham’s law and the role of cryptocurrencies as a store of wealth are inextricably linked. Because of their scarcity and widespread use as digital assets similar to gold, some digital currencies, such as Bitcoin (BTC), are considered as relatively stable and valuable.

Users are more inclined to retain cryptocurrencies as a hedge against inflation or financial turmoil, similar to how people have stored precious metals. More volatile cryptocurrencies, on the other hand, are widely used in speculative trading, reflecting Gresham’s law’s idea of good money and bad money.

Stablecoins – cryptocurrencies linked to traditional assets such as fiat money or commodities — have a huge impact on Gresham’s law in the cryptocurrency industry. Because of their consistent worth, these dependable digital assets are preferred for everyday transactions and serve as the modern counterpart of cash.

Furthermore, people’s usage and prioritisation of various digital assets are being influenced by the rising acceptability and incorporation of cryptocurrencies within financial institutions, which is consistent with the ideas presented by Gresham’s law.

How does the law affect the competition between cryptocurrencies and traditional currencies?

Gresham’s law emphasises the importance of perceived money quality, hoarding incentives, volatility concerns, and legal and regulatory factors in the rivalry between cryptocurrencies and fiat money.

Gresham’s law explains the mechanisms at work in the continuous conflict between cryptocurrencies and fiat money. It highlights people’s proclivity to swap or hoard less desirable sorts of currency while favouring and employing what they regard to be superior money. People tend to hoard cryptocurrencies while utilising traditional money for daily transactions because cryptocurrencies are perceived as investment assets with the potential for value appreciation.

Consider the following scenario: a person owns both US money and Bitcoin. The individual would most likely opt to utilise US dollars for routine expenditures, understanding that the value of the US dollar erodes over time due to inflation. On the other side, people may opt not to spend their Bitcoin since they would miss out on the chance of future value development.

Furthermore, Gresham’s law suggests that individuals will avoid cryptocurrencies out of fear of changing value, preferring the stability of fiat money for everyday transactions. Because of the volatility risk, cryptocurrencies may be used only in high-value transactions or as a store of value.

Businesses often accept traditional currencies for transactions since they are legal money in their respective nations. The legal climate around cryptocurrencies, on the other hand, is murky and confusing.

As a result, when restrictions come into play, people may opt to utilise conventional currencies. China’s cryptocurrency prohibition is an excellent illustration of how rules may impact currency selection. Because of the regulatory restrictions and penalties linked with cryptocurrencies, the prohibition forces individuals to utilise traditional money, the yuan.

Limitations of Gresham’s law

While Gresham’s rule is a useful idea in currency dynamics, it has limits, such as the volatility of cryptocurrencies and the changing global financial scene.

The law, while a useful notion in currency dynamics, has limits that apply to the arena of cryptocurrencies. One of its major shortcomings is the assumption of steady exchange rates.

In actuality, currency rates fluctuate, and interpreting the law becomes more difficult in a global market where digital currencies typically have fluctuating values. Furthermore, contrary to Gresham’s predictions, government actions such as currency limitations and pegs may artificially maintain poor money in circulation.

Psychological variables also play an important influence. Gresham’s expectations may not match people’s (particularly older generations’) attachment to traditional currencies because to cultural effects, familiarity, and trust. Furthermore, the tremendous volatility of cryptocurrencies offers a particular problem.

Most individuals are hesitant to use them because they risk suffering rapid value changes, but some keep them in the expectation of appreciation. This brings the implementation of the law into doubt by blurring the distinction between good and bad money.

Finally, the shifting landscape of payment systems and fintech advances confuses the classic application of Gresham’s rule, necessitating a more comprehensive understanding of current currency dynamics.